MENUMENU

TALK TO AN EXPERT

Special Hours: 7AM – 6PM PST

TALK TO AN EXPERT

Special Hours: 7AM – 6PM PST

We all love living life on the road. If you’re in the know, the thought of upgrading your rig with solar and reliable energy storage is bound to cross your mind. Well, good news–there are tax incentives available for just that!

Have you heard about the Inflation Reduction Act? It’s a special tax act to combat climate change, and RV owners, homeowners, and small businesses can benefit from it.

The Inflation Reduction Act incentivizes the use of renewable energy sources. Homeowners can receive up to a 30% tax credit for purchasing a standalone battery and battery installation without needing solar panels, depending on the date of installation. RV homeowners can receive a 22% deduction on the cost of an energy storage system from federal income tax under Section 25D of the ITC.

The Act also supports local clean energy initiatives and invests in disadvantaged communities, forest, and coastal restoration. To qualify for the clean energy tax credit, the battery capacity for home energy storage must be at least 3 kilowatt hours.

These tax credits are significant financial incentives for solar and energy storage in the United States. This program applies to all dwelling units, including houses, mobile homes, boats, and RVs. If your RV meets the criteria and is recognized by the IRS as a second home for tax purposes, you can apply for this tax credit even if you live on the road.

If you already have panels installed on your RV, remember that this tax credit applies to a battery installation!

If you are an RV owner or homeowner interested in going solar and claiming the credit through the Inflation Reduction Act, understanding what can be leveraged is essential. Here is a simple breakdown:

Calling all DIYers! You can even install a reliable lithium storage system if you want to reduce expenses. If you are new to building or installing electric systems, Battle Born Batteries is a wealth of available resources to walk you through the installation. Our Technical Sales Specialists are one phone call away to help you out: (855) 292-2831

Claiming the tax credit for your RV means specific eligibility criteria must be met.

First, confirm that you qualify for up to 30% tax credit based on the criteria above. During purchasing and installing your system, you must keep track of all your expenses and receipts. Then, when filing taxes next year, you must complete IRS Form 5965 to claim the credit. You will also add the credit to your Form 1040 when you file your tax return.

It’s essential to make sure you file everything correctly to ensure you receive the credit you deserve. Consider consulting with your accountant or a tax professional to help you.

Pro Tip! Keeping track of all qualifying expenses and filing the appropriate paperwork allows you to take advantage of the RV solar tax credit and save money while helping the environment.

Solar panels on an RV function similarly to how they function for a home–they harness sunlight and convert it to energy for appliances. Setting up solar panels on your RV is a fairly straightforward process.

If you enjoy spending extended time on the road, a solar setup can be a cost-effective and eco-friendly way to transition to using renewable energy. The systems are generally low-maintenance and allow a reasonable amount of power when the sun shines. However, that is the key–solar panels are only ideal when the sun is shining. You’ll need a reliable lithium battery system to store that energy to utilize renewable energy when the sun is not shining, whether from inclement weather, forests, tree cover, or lack of access to consistent sunshine.

Lithium batteries are the most reliable way to efficiently harness the power of renewables–storing solar energy for later use! Lithium-ion batteries have high energy efficiency, allowing RVers to utilize more power. Due to their low internal resistance, charging is highly efficient, and they charge rapidly. The energy in equals energy out with lithium-ion batteries.

They also have a longer lifespan than lead-acid batteries, which degrade much more quickly. RV owners can consider lithium-ion batteries a long-term investment since they can last ten times longer than their lead-acid counterparts and offer around 5,000 usable deep-cycle, complete discharges, equating to 10-15 years of service.

Lithium-ion batteries are safer than lead-acid batteries due to the latest, innovative technology. Batteries using LiFePO4 technology, such as Battle Born Batteries, are safe and have extra protection through our state-of-the-art battery management system (BMS). An even better perk, lithium-ion batteries do not need maintenance and do not produce any gases or spill liquids, making them much safer for RV use and installation anywhere (even under your bed)!

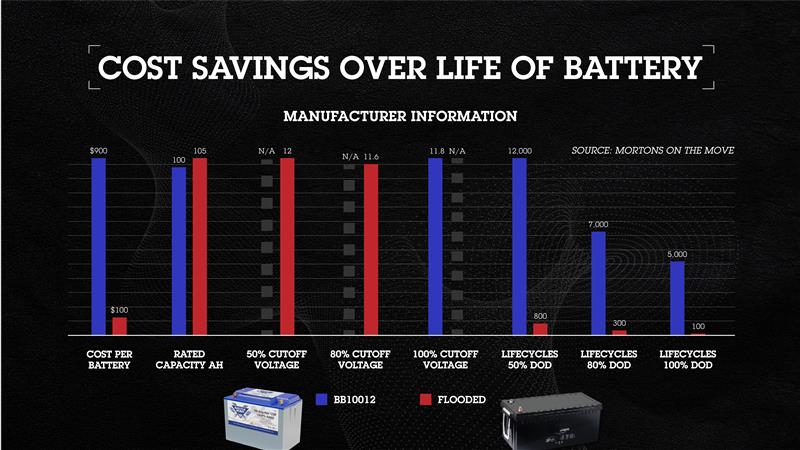

Although lithium-ion batteries have a higher upfront cost than lead-acid batteries, they are more cost-effective in the long run. They can safely discharge up to 85%, compared to lead-acid batteries, which can only discharge up to 50%. Lithium-ion batteries offer more stored energy for actual use and have a lower lifecycle cost, making them more cost-effective.

Switching to renewable energy sources like solar and lithium-ion batteries is a solid investment for RV homeowners and homeowners alike. The financial incentives are significant, with the Inflation Reduction Act providing tax credits for purchasing and installing standalone batteries and solar panels.

Lithium-ion batteries offer numerous benefits over lead-acid batteries, including higher energy efficiency, longer lifespan, safety, and lower lifecycle cost. Their low maintenance requirements and battery management system make them an excellent option for RV use. By taking advantage of the Inflation Reduction Act and investing in renewable energy sources, RV owners can enjoy the freedom of the open road. Get out there and stay out there!

* Please Note: While we are not tax professionals, we wanted to offer this helpful information for you to save! Please consult with your tax professional for advice.

Shop Best Sellers

Ask a technical specialist now at 855.292.2831

Stay in the Know

One thought on “Solar Tax Incentives for RV Homeowners”

I thought this was amazing use of this program. I could buy batteries for 30% off. Then I looked at IRS form 5696. Line 17a specifically ask if the energy improvements installed in or on your main home. If I answer yes I will have lied to the IRS because it would be in my travel trailer. What strategies do you suggest so one doesn’t have to commit fraud.